Many are present at campus protests that express their solidarity with the Palestinian people and speak out against the Israeli military operation within the Gaza Strip calls for universities and colleges to be divested – a word that essentially means “sell” – all of their assets linked to Israel or linked to corporations that provide weapons and technology to the Israeli government. The Conversation US asked Todd L. Elya public administration scholar on the University of Colorado Denver to elucidate the challenges of meeting this demand.

What are foundations?

Foundations are pools of assets that originally come from donations. Nonprofits and a few public organizations invest these assets, which grow over time, and spend a small percentage of them annually to support their missions. Almost all non-profit Colleges and universities have endowmentsin addition to Hundreds of public colleges – partly via affiliated charitable foundations.

U.S. college and university endowments had around $1 trillion in assets (as of mid-2021). – probably the most current comprehensive data available.

This wealth is very concentrated. Almost half of those assets belonged to the 20 largest foundations in 2021. Foundation value $40 million or less is more typical and about 95% of schools and universities have lower than $1 billion in endowments.

Foundation managers generally see Making money is their primary goal and enormous amounts of those assets are subject to restrictions based on donor preferences.

Columbia University's $13.6 billion endowmentFor example, as of 2023, the fund was divided into greater than 6,200 different funds and about two-thirds of the muse's assets were subject to donor-related restrictions.

As colleges and universities aim to preserve their endowments to support their operations for the foreseeable future, they’re typically spend about 5% of those assets per 12 months for student aid and various programs to complement what they will afford from their other income – primarily tuition fees, room and board fees, and government funding for public facilities. The Columbia Foundation, for instance, paid out $679 million in fiscal 12 months 2023.

Many protesters have said they oppose their tuition going to a foundation with financial ties to Israel. But that is not how foundations work. Typically universities and colleges Spend all the cash you get from tuition on core businesses. They complement these funds with income from other sources – including their foundations.

How much details about foundations is published?

Since it’s unclear how much of those assets are tied to Israeli corporations or the Israeli military, many protesters are calling on their colleges and universities to achieve this reveal further information about what’s included of their foundations.

While universities and colleges typically publish their audited financial reports annually, details in regards to the holdings of their endowments are difficult to seek out for several reasons.

First, professionally managed investments change so incessantly What is contained in a trust is a moving goal. Regular reporting reflects, at best, a historical snapshot.

Second, university facilities are complex. Timely and detailed reporting on investments, while it’s desirable for supervisioncan reveal that secret proprietary strategies of foundations and their investments, including Alternative investments resembling hedge funds.

Third, colleges and universities are increasingly hiring external asset managers and hedge funds to administer their endowments. Due to the proprietary nature of those transactions, it might be obligatory to agree to take care of confidentiality regarding these investments.

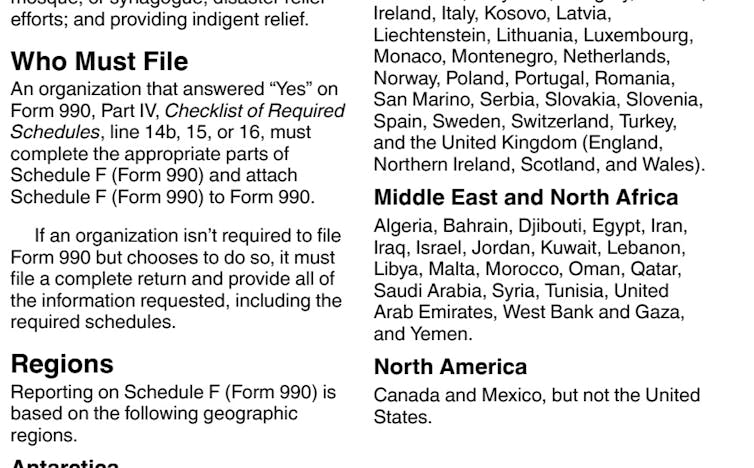

Some details about foundations appears in 990 Forms, that are information statements that charities file and publish annually with the Internal Revenue Service. This is the shape Schedule D includes the dimensions of the muse, its administrative costs and the overall limitations it faces.

Although the forms require disclosure of “activities outside the United States.” Schedule FThe highest level of detail required is the region of those investments. In other words, any investments in Israeli corporations could possibly be lumped in with investments in corporations based in Qatar or Lebanon.

Internal financial service

Are there legal obstacles?

Universities and colleges may not at all times have the liberty to divest their endowments.

When it involves cutting ties with Israel, a minimum of there are laws 38 states have banned this sort of sale for public universities by banning participation within the Boycott, Divestment and Sanctions (BDS) movement, which has sought to place pressure on Israel for nearly 20 years.

Other state laws more generally restrict using environmental, social and governance (ESG) investment practices by public institutions.

For example, officials at Ohio State University have cited their state's laws when telling protesters that this will not be possible breaks off relations with Israel.

In addition, just about all states have a law that regulates the investment and use of funds by nonprofit organizations: the Uniform Prudent Management of Institutional Funds Act. This measure requires a “prudent” investment approach, which could be interpreted as an try to maximize the expansion of a foundation.

However, some divestment advocates argue that schools and universities have one moral duty to divest in certain cases are based on the identical laws – even when which means that a foundation may grow more slowly.

Is disinvestment from Israel feasible?

Certainly many colleges and universities have done this agreed to student demands for divestment in recent times from industries resembling tobacco, fossil fuels, private prisons and firearms. About 40 years ago, a whole lot of faculties divested from corporations doing business in South Africa before the autumn of his apartheid government.

But it will be difficult to find out which specific assets would must be sold after which avoided for the foreseeable future if today's protesters prevailed.

Regardless of the main focus of those campaigns, implementing divestments requires political will, effort and time. In addition, transaction costs increase, access to certain investment products is proscribed and it will probably take a protracted time attributable to the best way higher quality endowments are invested.

That's partly because endowments typically don't just include large amounts of stocks and bonds. To reduce risk, they’re increasingly investing in mutual funds and other assets consisting of many various securities. Outsourcing the management of parts of your portfolio to non-public equity firms results in further complications.

“The university has no discretion to withdraw its investments in private equity and real asset funds,” Columbia University said noted in its audited annual financial statements for 2023. “Distributions occur when assets within the funds are sold. In general, the remaining term of these private equity and real asset funds is up to 12 years.”

There's one other concern for colleges and universities: Many of their largest donors have made this clear They are against disinvestment from Israel. In some cases, these donors have said they might stop giving to varsities that cut ties with Israel, as protesters demanded.

Does divestment work?

Whether divestment works likely will depend on the goals of its proponents.

If they wish to inflict significant financial losses on specific corporations, industries or countries, research shows they’re doomed to fail for several reasons.

Although many college and university endowments are large by most standards, they’re aren’t necessarily sufficiently big to maneuver the financial marketsespecially since their investments are diversified.

Additionally, if a university owns shares in a goal company, selling those shares simply transfers ownership to a buyer who’s less concerned about social issues.

property preservation and Taking a more energetic role in representing investor interests could possibly be an alternative choice to divestment.

But if the goal is that raise awareness of a causethen divestment could make a difference – even whether it is difficult to measure.

AP Photo/David Goldman

How can colleges and universities reply to student demands?

Some colleges and universities have found ways to interact productively with protesters. sometimes this even led to an amicable end to the camps.

Increasing engagement opportunities for college kids and the broader academic community around endowments and other institutional investments may provide a approach to address current and future disputes.

Brown University, Northwestern University and that University of Minnesota appear to be taking this approach.

Some colleges and universities have promised to review divestiture claims at a later date and disclose more information in regards to the size of their endowments. These commitments have helped to take care of peace while ensuring that this can proceed to be the case on this matter remain on the agenda within the 2024-2025 academic 12 months.

image credit : theconversation.com

Leave a Reply