America's first large offshore wind farms began sending electricity

to the Northeast in early 2024, but a wave of wind farm project cancellations and rising costs have raised doubts amongst many individuals in regards to the way forward for the industry within the United States

Several big hitters have done so, including Ørsted, Equinor, BP and Avangrid terminated contracts or tried to renegotiate them in the previous few months. The withdrawal meant that the businesses faced cancellation penalties of $16 million as much as several hundred million dollars per project. This also led to Siemens Energy, the world's largest manufacturer of offshore wind turbines, expect financial losses in 2024 of around 2.2 billion US dollars.

Overall, the projects that were canceled by the tip of 2023 are prone to add up greater than 12 gigawatts of powerwhich corresponds to greater than half of the capability within the project pipeline.

So what happened and might the U.S. offshore wind industry recuperate?

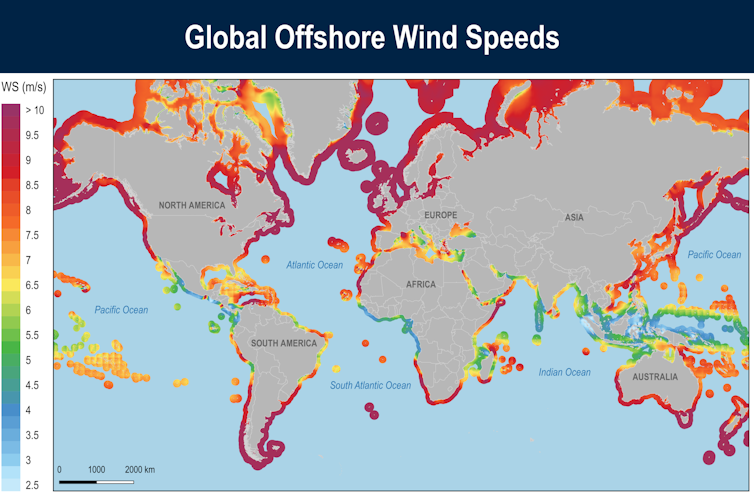

ESMAP/The World Bank via Wikimedia, CC BY

I direct the Center for Wind Energy Science Technology and Research at UMass Lowell WindSTAR And Center for Energy Innovation and follow the industry closely. The offshore wind industry's problems are complicated, but it surely's removed from dead within the U.S., and a few policy changes could help it get on firmer footing.

The long approval process is stuffed with challenges

Approve and get offshore wind projects approved within the US takes years and is fraught with uncertainty for developers, more so than in Europe or Asia.

Before an organization submits a bid for a U.S. project, the developer must plan the procurement of your entire wind farm, including reservations for the acquisition of components similar to turbines and cables, construction equipment and ships. The bid also must be cost competitive, so corporations are likely to bid low and never anticipate unexpected costs, increasing financial uncertainty and risk.

So the successful US bidder acquires an expensive ocean leaseCosts within the Hundreds of tens of millions of dollars. But it doesn't yet have the appropriate to construct a wind project.

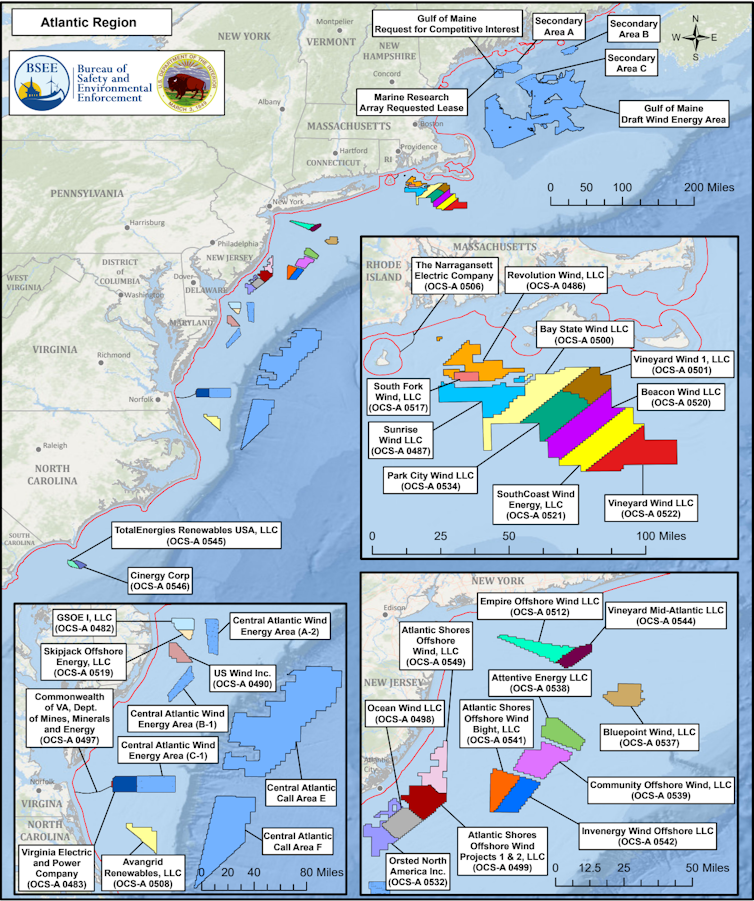

US Department of the Interior, 2024

Before construction begins, the developer must conduct site assessments to find out this What foundations are possible and show the scope of the project. The developer must enter into an agreement to sell the electricity it generates. discover a connection point to attach it to the ability grid after which create a construction and operating plan that’s subject to further steps Environmental assessment. This all takes about five years and is just the start.

In order for a project to maneuver forward, developers might have to perform hedging Dozens of permits by local, tribal, state, regional and federal authorities. The Federal Office for Marine Energy Management, which is responsible B. on the leasing and management of the seabed, must seek the advice of with authorities which have regulatory responsibility for various points of the ocean, similar to: B. the armed forces, the Environmental Protection Agency and the National Marine Fisheries Service, in addition to groups similar to business and recreational fishing and indigenous groups, shipping, port managers and property owners.

For Vineyard Wind I – which one began sending electricity from five on of its 62 planned wind turbines off Martha's Vineyard in early 2024 – the time from BOEM's lease auction to the primary electricity being fed into the grid was around nine years.

During regulatory delays, costs can skyrocket

Until recently, these contracts didn’t include mechanisms to regulate for rising delivery costs in the course of the long approval period, increasing risk for developers.

From the tendering of today's projects to their construction approval, the world has faced the COVID-19 pandemic, inflation, global supply chain issues, increased financing costs and the war in Ukraine. Sharp rise in raw material prices, also for steel and copperin addition to construction and operating costs meant that contracts signed a few years previously could now not be financed.

New contracts and re-tendering agreements now allow price adjustments after environmental approvals are granted, making projects more attractive to developers within the US. Many of the businesses that canceled projects at the moment are bidding again.

The regulatory process is develop into slimmerbut it surely still takes about six years Other countries are constructing Execute projects faster and on a bigger scale.

Shipping regulations, power connections

Another major hurdle to the event of offshore wind turbines within the United States is a century-old law called the Jones law.

The Jones Act requires ships carrying cargo between U.S. points to be U.S.-built, U.S.-operated, and U.S.-owned. It was written to stimulate the shipping industry after the First World War. However, there are only three offshore wind turbine installation vessels on the earth large enough to accommodate the turbines proposed for U.S. projects, and none are Jones Act compliant.

That means wind turbine components should be transported from U.S. ports on smaller barges after which installed by a foreign installation ship waiting offshore, increasing costs and the likelihood of delays.

AP Photo/Seth Wenig

Dominion Energy is installing latest ship, the Charybdisthat can comply with the Jones Act. But a typical offshore wind farm requires over 25 several types of vessels – for crew transfers, surveying, environmental monitoring, cable laying, heavy lifting and plenty of other tasks.

Also the nation There is a scarcity of well-trained employees for the manufacture, construction and operation of offshore wind farms.

In order for electricity to flow from offshore wind farms, significant modernization of the ability grid can also be required. The Department of Energy is Working on regional transmission plansbut approval will undoubtedly be slow.

Lawsuits and disinformation increase the challenges

Numerous lawsuits from interest groups opposing offshore wind projects have further slowed development.

Wealthy homeowners have tried to stop wind farms that would appear of their ocean views. artificial grass Groups that claim to be environmental advocates but actually are supported by fossil fuel industry interestshave Disinformation campaigns launched.

In 2023, many Republican politicians and conservative groups are on board immediately Blame whale deaths off the coast of New York and New Jersey on the offshore wind power developers, however the Rather, there are indications of increased shipping traffic Collisions and entanglements with fishing gear.

Such disinformation can reduce public support and slow the progress of projects.

Efforts to maintain the offshore wind industry running

The Biden administration has set one The goal is to put in 30 gigawatts The variety of offshore wind turbines will increase by 2030, but recent estimates suggest that the actual number shall be closer to this number more like half of it.

AP Photo/David Goldman

Despite the challenges, developers have reason to maintain going.

The Inflation Reduction Act offers incentives, amongst other things: Federal tax credits for the event of unpolluted energy projects and for developers construct the port facilities in locations that previously relied on the fossil fuel industry. Most coastal state governments also facilitate projects by allowing price adjustment after environmental permits are granted. They see offshore wind power as a possibility for economic growth.

These financial advantages could make constructing an offshore wind industry more attractive to corporations that need market stability and a project pipeline to cut back costs – projects that may create jobs, stimulate economic growth and create a cleaner environment.

image credit : theconversation.com

Leave a Reply